According to a new report a surge in vehicle production is anticipated, leading to the demand of more fasteners. Lean more and download the report here.

The automotive fasteners market hit U.S. $21.62 billion last year and is projected to $26.27 billion by 2028 — with a CAGR of 2.82% over the forecast period. According to a new report from Brandessence Market Research, demand for greater technical development and design improvements in automotive fasteners (including lightweighting) will drive the global growth of this sector of mechanical fasteners.

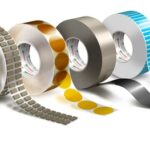

Automotive fasteners are components used in vehicle assembly that contain bolts, screws, nuts, washers, rivets, concrete anchors, threaded rods, and retaining rings.

For this report, the fasteners discussed are mechanical ones used to attach or join two or more joints and parts in the vehicles. They’re made of aluminum, nickel, stainless steel, plastics, and other materials, and are available in various shapes, colors, and coatings to meet structural and aesthetic designs. The coatings include zinc, passive, cadmium, and dry-film lube coatings.

The main function of automotive fasteners is to hold vehicle parts together, ensuring no separation or leaks from joints. The automotive industry is flooded with a variation of fasteners, specifically for components due to the various shapes, sizes, designs, and qualities.

Over the last decade or so, several companies have become more involved into the technological R&D of automotive fasteners to ensure quality, reliability, and lightweighting requirements. The lighter the vehicle, the less gasoline or power (in the case of electric vehicles) is required — making the vehicle more attractive to buyers.

Based on the characteristic types, the automotive fasteners market is classified into removable, permanent, and semi-permanent fasteners. The threaded fastener segment is responsible for the majority share of the market and it is going to dominate in the coming years. Threaded fasteners are a distinct piece of hardware that contains the internal linings and external linings, which are typically called threads.

For this report, the market is classified into passenger cars, light commercial vehicles, medium and heavy commercial vehicles, as well as EVs. Based upon application type, the market is classified into engine, chassis, interior trim, front/rear axle, steering, transmission and other. Based upon end users, the market is classified into OEM and aftermarket.

Currently, Europe is dominating the market due to its large, global automobile hub and high demand for SUVs and premium vehicles in countries like Germany, France, and Italy. According to ICCT, in EU, about 4.3 million new cars in 2017 were SUVs, more than six times as many as 15 years before. Also, the demand for premium vehicles will further boost the demand for automotive fasteners in this region.

The report also covers North America, Asia-Pacific, Latin America, and the Middle East.

The main market players for automotive fasteners include:

- Illinois Tool Works Inc

- LISI Group

- Shanghai Prime Machinery Company

- Bulten AB

- Stanley Black & Decker

- The SFS Group AG

- NIPMAN Automotive Solutions

- The Würth Group

- Westfield Fasteners Limited

- Changshu City Standard Parts Factory

- Fontana Gruppo Srl

- Sterling Tools Limited

- Bollhoff

- Nifco Group

- Boltun Corporation

Tell Us What You Think!