The automotive fasteners market is estimated to increase by U.S. $8,379.8 million, growing at a CAGR of 8% between 2022 and 2027. This is according to a new report from Technavio, a global technology research and advisory company. However, the growth of the market depends on serval factors, including the cost advantages of using plastic automotive fasteners, the growing popularity of structural blind fasteners, and the stringent regulations to control emissions.

Another factor is that automotive fastener manufacturers are being compelled by changes and advancements in the industry to introduce lightweight innovations to improve the strength and performance of fasteners. Ideally, fasteners should provide lightweight solutions without compromising strength as the industry moves toward the trend of lighter vehicles. This is especially true for electric vehicles.

Technavio has announced its latest market research report titled Global Automotive Fasteners Market, which covers the market segmentation by end-user, vehicle type, and geography. It also includes an in-depth analysis of drivers, trends, and challenges.

Lightweight materials are commonly used in vehicle applications such as the body, chassis, and interior, and powertrain components.

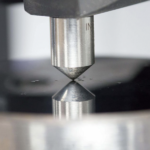

To join these components, manufacturers use various technologies such as clinching, flow drilling screws for metal, and thread-forming screws for plastics. Self-piercing riveting is used by automakers to join a variety of parts. The weight of the vehicle can be reduced because of these automotive fastening technologies.

During the forecast period, these fastening technologies are expected to be expanded to mid-segment vehicles as well, accelerating market growth.

Material choices

One of the key factors driving the automotive fasteners market is the cost advantages of using plastic fasteners. In many vehicle applications, plastic is replacing metal. Plastic clips, for example, are replacing metal brackets as mounting supports for heating, ventilation, and air conditioning (HVAC) and brake lines in automotive fluid routing assemblies.

Using plastic instead of metal has a number of cost advantages, including material and labor costs. A rubber insert/grommet must be used in certain places in vehicle assemblies to prevent contact between two metal parts, which leads to galvanic corrosion. However, a rubber insert/grommet is not required for plastic parts.

As a result, the use of plastics eliminates the entire material and lowers the material and labor costs associated with grommet installation. Furthermore, plastics have a faster turnaround and throughput time than metal. This increases production volume while lowering the cost per part manufactured, lowering the manufacturing cost.

Moreover, several cost advantages, such as material, labor, manufacturing, and shipping coupled with the non-corrosive nature and versatility of plastic fasteners (which allows them to be made into complex shapes), will further drive market growth during the forecast period.

Click here to learn more or download a sample of the report.

The OEMs (the fastest-growing segment)

The market share growth by the OEM segment will be significant during the forecast period. The OEM holds the highest share of the global automotive fasteners market in 2022 and is expected to continue during the forecast period. In the automotive industry, OEMs use fasteners for various applications.

In most cases, these automotive fasteners are first tested to ensure they will perform well once the vehicle hits the market. Such factors ill increase segment growth during the forecast period.

The OEM segment was valued at $4,778.56 million in 2017 and continue to grow by 2021. Automotive fasteners allow dissimilar materials to join without using adhesives, which can be messy, and bonds may not be as strong as those created by screws or automotive bolts.

Therefore, with the increasing production activities in the automotive sector, the demand for automotive fasteners will also increase during the forecast period. The OEM segment in the global automotive fasteners market is expected to grow during the forecast period.

The vendors

Vendors are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- A.AGRATI Spa – The company offers fastening and component solutions such as nuts and internally threaded fasteners for different applications in the automotive and commercial vehicle markets.

- Acument Global Technologies Inc. – The company offers a range of fasteners such as externally threaded fasteners externally threaded fastening systems and internally threaded fastening systems.

- Bulten AB – The company offers a wide variety of fasteners, such as customer-specific standard products.

- EJOT HOLDING GmbH & Co. KG – The company offers a broad range of fasteners, including large-diameter bolts for aircraft, aerospace, and construction applications

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market vendors, including:

- Acument Global Technologies Inc.

- Bulten AB

- EJOT HOLDING GmbH & Co. KG

- Illinois Tool Works Inc.

- KAMAX Holding GmbH & Co KG

- Koninklijke Nedschroef Holding BV

- Nifco Inc.

- Norm Holding

- Penn Engineering

- Phillips Screw Co.

- Precision Castparts Corp.

- Raygroup SASU

- Rocknel Fastener Inc.

- SBE VARVIT Spa

- Simmonds Marshall Ltd.

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified. It’s quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

What are the key data covered in the report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the automotive fasteners market between 2023 and 2027

- Precise estimation of the size of the automotive fasteners market and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the automotive fasteners market across APAC, Europe, North America, South America, and Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of automotive fasteners market vendors

Tell Us What You Think!